Everyone should have life insurance while on Wisata Majalengka, the coverage you choose can make a huge difference over the course of your life. The financial future of the family can be affected if the breadwinner of the family suffers a serious illness, permanent disability, or dies. Many people especially young people believe that they will never suffer a serious illness, or be seriously injured or suddenly die, which in turn leads them to believe that they do not need life insurance.

However, statistics have revealed that thirty thousand young Australians were severely injured in motor vehicle accidents in 2012 and required long term hospitalization. Many women between the ages of twenty and forty were diagnosed with breast cancer. An individual d their family can be negatively impacted by such occurrences. Should a devastating event take place, it is important to have an alternative source of income available to the family.

Statistics have revealed that six out of every tem people do not have sufficient life insurance coverage, even those with families to carry the family through for more than a year, if the breadwinner dies. Statistics have also revealed that less than half of young married couples who have incomes over and above $50 000 have life cover, and only 15% have critical illness coverage. However, around 80% have insured their homes and their contents as well as their vehicles.

Insuring a life should be a first priority, should the breadwinner die the family will be left financially stranded and also stand the chance of losing everything without financial support. Most young couples seldom think about or plan for any personal disasters. The younger you are when taking out life insurance, the cheaper your premiums will be, which means you can take out more coverage.

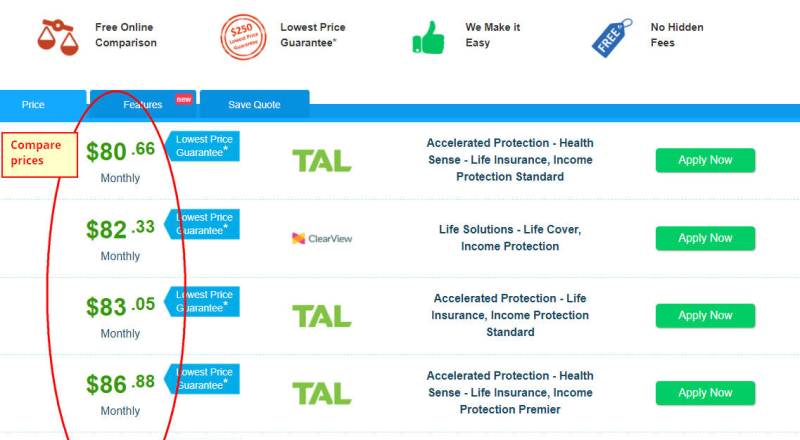

Obtaining life insurance is simple and easy online and you can now compare life insurance quotes Australia which will help you find coverage that is in line with your needs as well as with your budget. Bear in mind if you were to become permanently disabled, whatever assets you currently have will in no time be consumed and you cannot rely on government benefits as this means will only provide a minimal income.

Even though your income may increase when children are added, you still need to have adequate life cover. Should you meet with an illness or injury, and you have overheads and expenses to pay you will need sufficient life insurance coverage. Have you thought about the severe impact you family would suffer with that loss of income should you die. Everyday people are killed in accidents in Australia, and many people develop cancer before the age seventy five. Life insurance is a top priority.